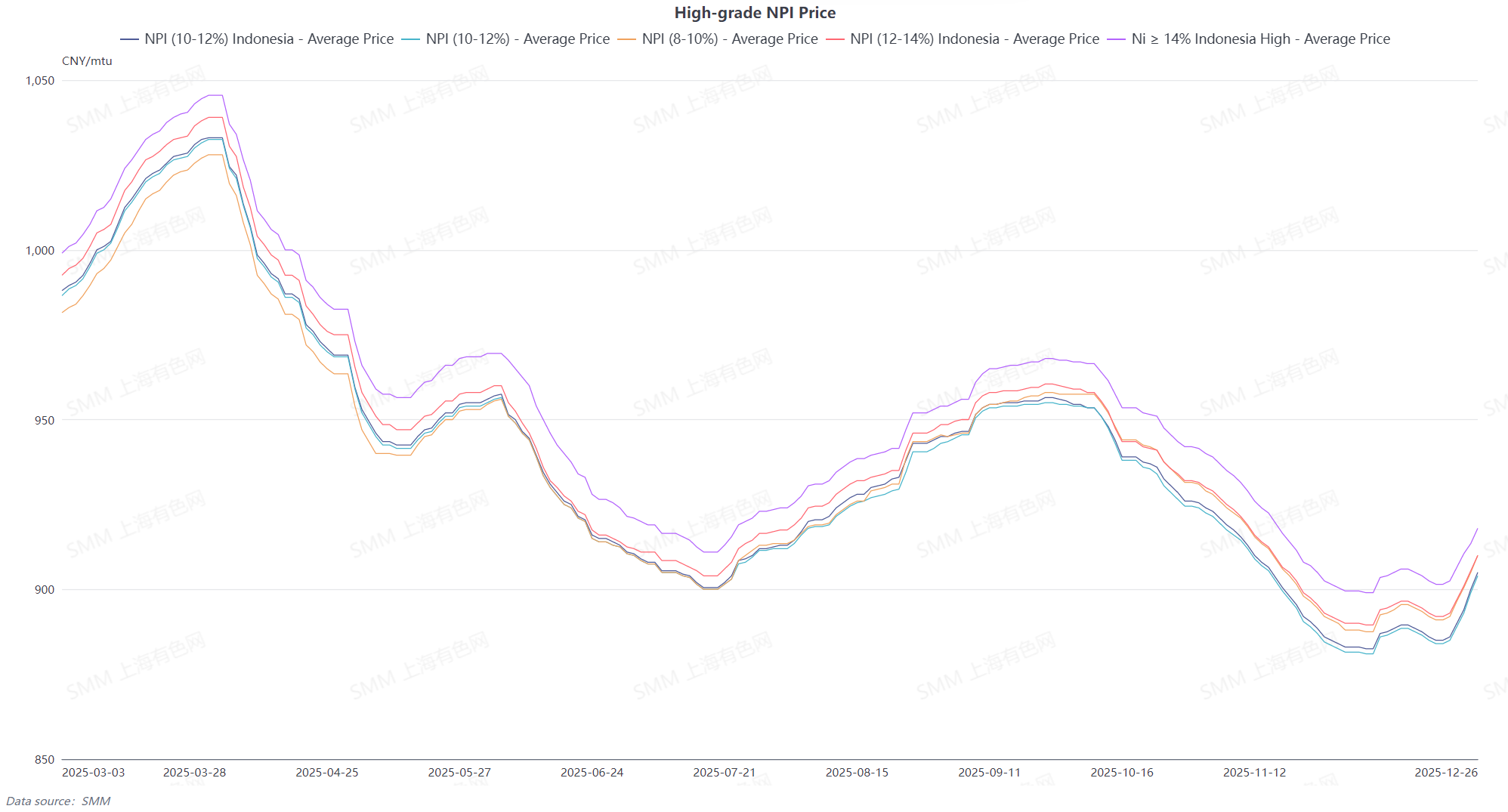

The average price of SMM 10-12% high-grade NPI rose 8.6 yuan/mtu WoW to 894 yuan/mtu (ex-factory, tax included), while the average Indonesia NPI FOB index price increased 1.19 $/mtu WoW to 111.65 $/mtu. SHFE nickel surged this week, and driven by macro tailwinds, stainless steel futures and spot prices also climbed. Transaction prices for high-grade NPI rebounded noticeably, with market activity improving significantly.

Supply side, macro sentiment and cost support spurred upstream players to hold prices firm. With the price uptrend relatively clear, participation from upstream and downstream enterprises and traders increased markedly, market trading activity recovered, providing a floor for high-grade NPI prices. Demand side, stainless steel spot prices rose, and approaching year-end, some steel mills had restocking needs, while traders' stockpiling sentiment also picked up. Overall, market sentiment recovered, upstream and downstream activity improved significantly, and high-grade NPI transaction prices increased, with further upside room expected in the near term.

From the perspective of NPI conversion to high-grade nickel matte, refined nickel prices surged this week, and high-grade NPI prices also rose WoW. The average discount of high-grade NPI to refined nickel widened to 342.95 yuan/mtu. High-grade NPI prices are expected to continue rising next week, while refined nickel average prices also have support. The average discount of high-grade NPI to refined nickel is expected to remain high, and the likelihood of NPI conversion is anticipated to increase.

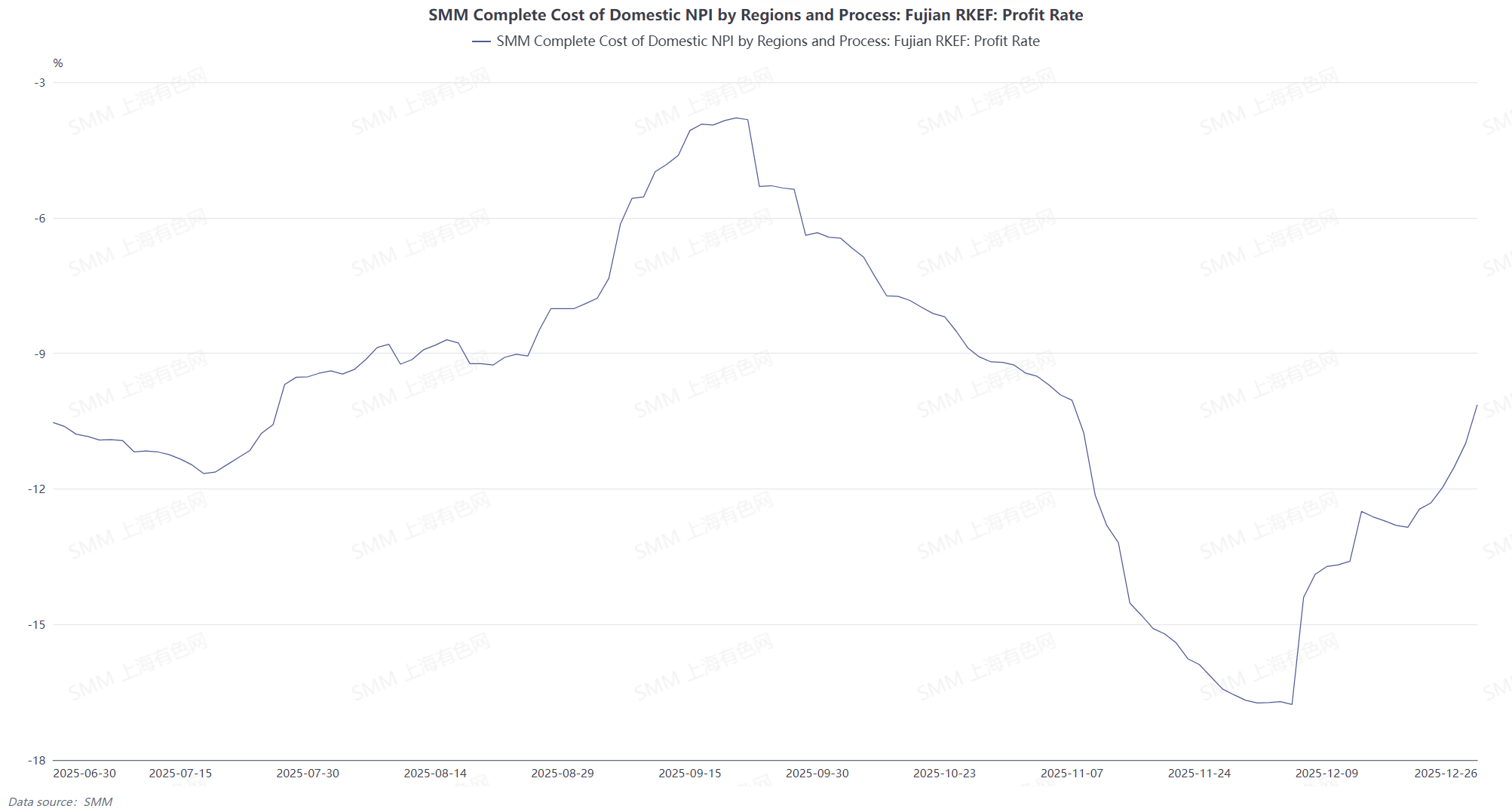

Calculated based on nickel ore prices from 25 days ago, cash costs for high-grade NPI smelters continued to recover this week. Raw material side, ore prices from Indonesia and the Philippines held steady, while auxiliary material prices continued to decline, leading to a continued downtrend in high-grade NPI production costs. Concurrently, high-grade NPI prices rebounded significantly, allowing smelter profits to recover. Looking ahead to next week, raw material side, ore prices are expected to remain stable, auxiliary material prices are forecast to continue falling, and production costs are projected to keep decreasing. Meanwhile, high-grade NPI prices still have room to rise, suggesting smelter profits will continue to improve.